The Great Depression: Problem, Reaction, Solution

While it is common to blame the Great Depression on greedy capitalists, the unpredictability of the free market, the gold standard and even consumers, none of these explanations hold up to empirical analysis, nor to basic economic science. The connection that binds these naysayers is threefold: statism, ignorance of economic theory or practice, and a general lean towards socialism. Whether it was the early national socialism of progressives like Richard T. Ely, the intellectually dishonest theory of John Maynard Keynes or the plethora or screeching Marxists during the late nineteenth century through the mid twentieth century, all of these ideals can be seen as creating and prolonging the Great Depression, as opposed to the contemporary rantings of these individuals and their theories as economic messiah’s that saved us from ourselves.

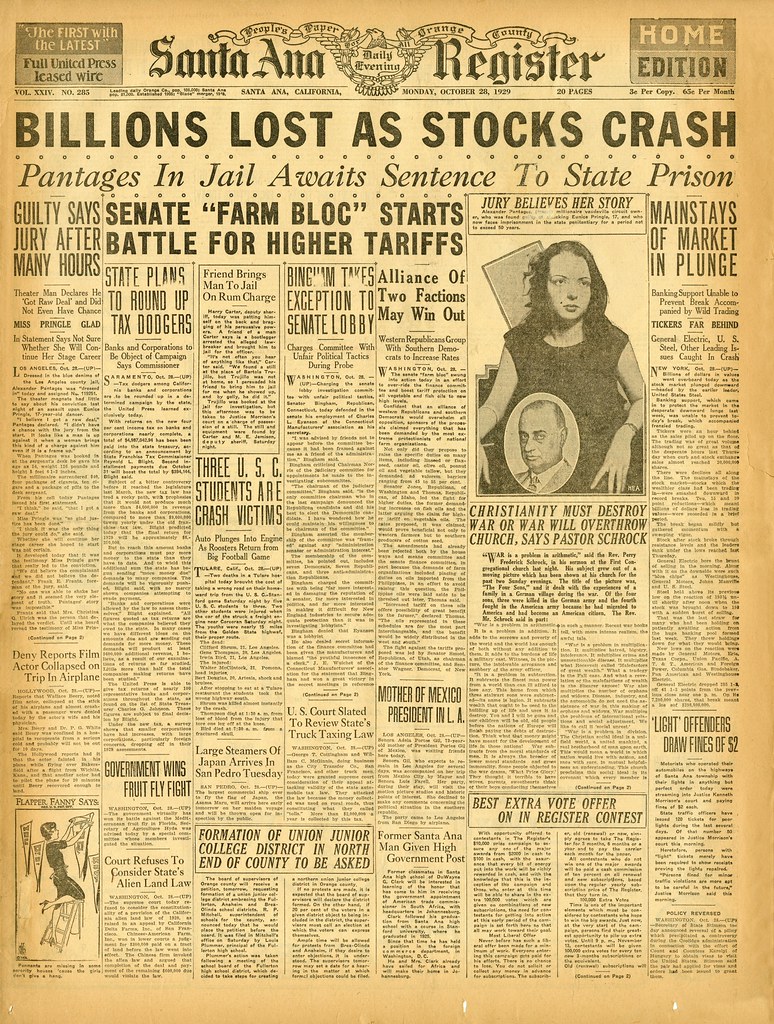

The Great Depression did not begin with 1929 stock market crash, but much earlier. Most classical economists point to various indicators of the Roaring 20’s as the catalyst for the Great Depression. Indeed, the four phases of causality offered by Friedman that begin with the massive economic boom of the 1920s, which he empirically shows was created by easy money and credit expansion via the Federal Reserve System. The massive printing of money, without hard asset support, in tandem with exquisitely low interest rates between 1924 and 1929, not only created an unsustainable economic bubble, but positioned the federal government and financiers towards enormous property grabs, further control over the means of production and leverage over the debt finance participants. In fact, the Reserve banks in less than a year, during 1924 “created” over $500 million in new credit, leading to a bank credit expansion of over $4 billion, which would become insolvent by 1929 and beyond. President Hoover had laid the groundwork for this statist economic model of expenditures, inflation and centralization.[1] FDR would follow it with his “New Deal” with a final blow to the free market through the Wagner Act.[2] The glaring question then becomes, how were these statist progressives, finance capitalists and crony capitalists able to create such swift and enduring policies and entities to obstruct and pervert America’s free market economy? Looking to the preceding movements by earlier progressive economists reveals the answer.

Richard T. Ely, the founder of progressivism and the conductor of the socialist symphony of the late nineteenth and early twentieth century would build the foundation upon which later comrades would be able to expand upon. Between 1880 and 1900, Ely and his merry band of political economists came to dominate the universities, foundations and government and one of Ely’s former students would make his way to the White House, Woodrow Wilson. The goals of these progressive economists of the early Progressive Era economists were nothing less than a form of national socialism. As Ely puts it, progressives are altogether dissatisfied with the condition of society and share a common ground as political and economic reformers of bringing about socialist changes through a steady and prolonged radicalism.[3] In Ely’s view the political economy conjured up by Marx and Engel was a natural evolution from the free market of capitalism to one of state control through progressive experts. In a desire to correct the supposed failings of free market capitalism, Ely ventured to perfect these inadequacies through state administration and trained experts through a purportedly new form of collectivization. His denotation of classical liberalism and free market capitalism as the “old way” and the progressive statism as the “new way” of political economy is revealing.[4] Woodrow Wilson and Herbert Hoover institutionalized Ely’s ideals, at a national level, bringing together finance capitalists, Big Business and government management of the economy, and the stage was set for the Great Depression, which inevitably transferred the money supply to the Federal Reserve, consolidated political power and created a state directed economy that would be furthered by FDR and the New Deal. Ely and his national socialists would pave the way for the Keynesian movement. While Ely blamed capitalism in general for the supposed woes of the world, John Maynard Keynes would go further and blame the individual consumer, and both believed only the government could save us from ourselves.

John Maynard Keynes and his “general theory” of economics became the dominant economic model most of the mid to late twentieth century. Much like Ely, Keynes was no friend of free market capitalism. According to Keynes the Great Depression was caused by the “animal spirits” of capitalists who refused to invest or spend, triggered the consumer pessimism that led to a lack of consumer consumption. Of course, according to the wisdom of Keynes, much like Ely, the only solution to this was government spending to offset the lack consumer consumption and private investment. He believed the best way forward was not necessarily more taxation, but monetary policy or in other words control of the money supply. This was accomplished through the Federal Reserve during the 1920’s money printing extravaganza and cheap credit, which simply inflated the money, drove prices artificially high and leveraged debt, that eventually brought the economy to its knees, allowing the federal government and financiers to move into the spotlight as the only means of salvation for the nation. This academic and economic myth, that capitalism was the cause of the Great Depression and only through government intervention was economic recovery found, continues today, without recourse nor justification.[5] Milton Friedman points out that this was not only a created crisis, but that the Federal Reserve first pumped liquidity into the money supply, but then stood down refusing carry out its assigned role of providing liquidity through cheap loans between 1929 and 1933, in essence watching the ship sink.[6] As early as 1934 this catastrophe was labeled as a “deliberate co-operation between Central bankers, deliberate ‘reflation’ on the part of the Federal Reserve authorities, which produced the worst phase of this stupendous fluctuation…which was responsible for the excesses of the American disaster.”[7]

[1] Murray N. Rothbard, America’s Great Depression, Auburn: Mises Institute, 1963: 285-336.

[2] Foundation for Economic Education, What Caused the Great Depression?, February 02, 2018, https://fee.org/articles/what-caused-the-great-depression/ (accessed July 29, 2021).

[3] Richard T. Ely, French and German Socialism in Modern Times, New York: Harper &

Brothers, 1883: 1-2.

[4] Richard T. Ely, “The Past and Present of Political Economy,” Edited by Herbert B. Adams, John Hopkins University Studies in Historical and Political Science (John Hopkins University) II, no. 3 (1884): 64.

[5] Lawrence Reed, Great Myths of the Great Depression, Mackinac Center for Public Policy, 2016: 1. https://fee.org/resources/great-myths-of-the-great-depression/.

[6] Ivan Pongracic Jr., “The Great Depression According to Milton Friedman,” Foundation for Economic Freedom, (September 1, 2007), https://fee.org/articles/the-great-depression-according-to-milton-friedman/.

[7] Lionel Robbins, The Great Depression, Freeport. New York: Books for Libraries Press, 1934, 54. https://cdn.mises.org/The%20Great%20Depression_2.pdf.

“Progressives are altogether dissatisfied with the condition of society and share a common ground as political and economic reformers of bringing about socialist changes through a steady and prolonged radicalism.” – Richard T. Ely

“Banks have done more injury to the religion, morality, tranquility, prosperity, and even wealth of the nation than they can have done or ever will do good.” – John Adams

“By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

– John Maynard Keynes

“There is one good thing about Marx: he was not a Keynesian.” – Murray Rothbard

israelnightclub says:

Itís difficult to find experienced people in this particular topic, but you seem like you know what youíre talking about! Thanks

נערות ליווי באשקלון says:

Good day! I just want to offer you a big thumbs up for your excellent information you have got here on this post. Ill be coming back to your blog for more soon.